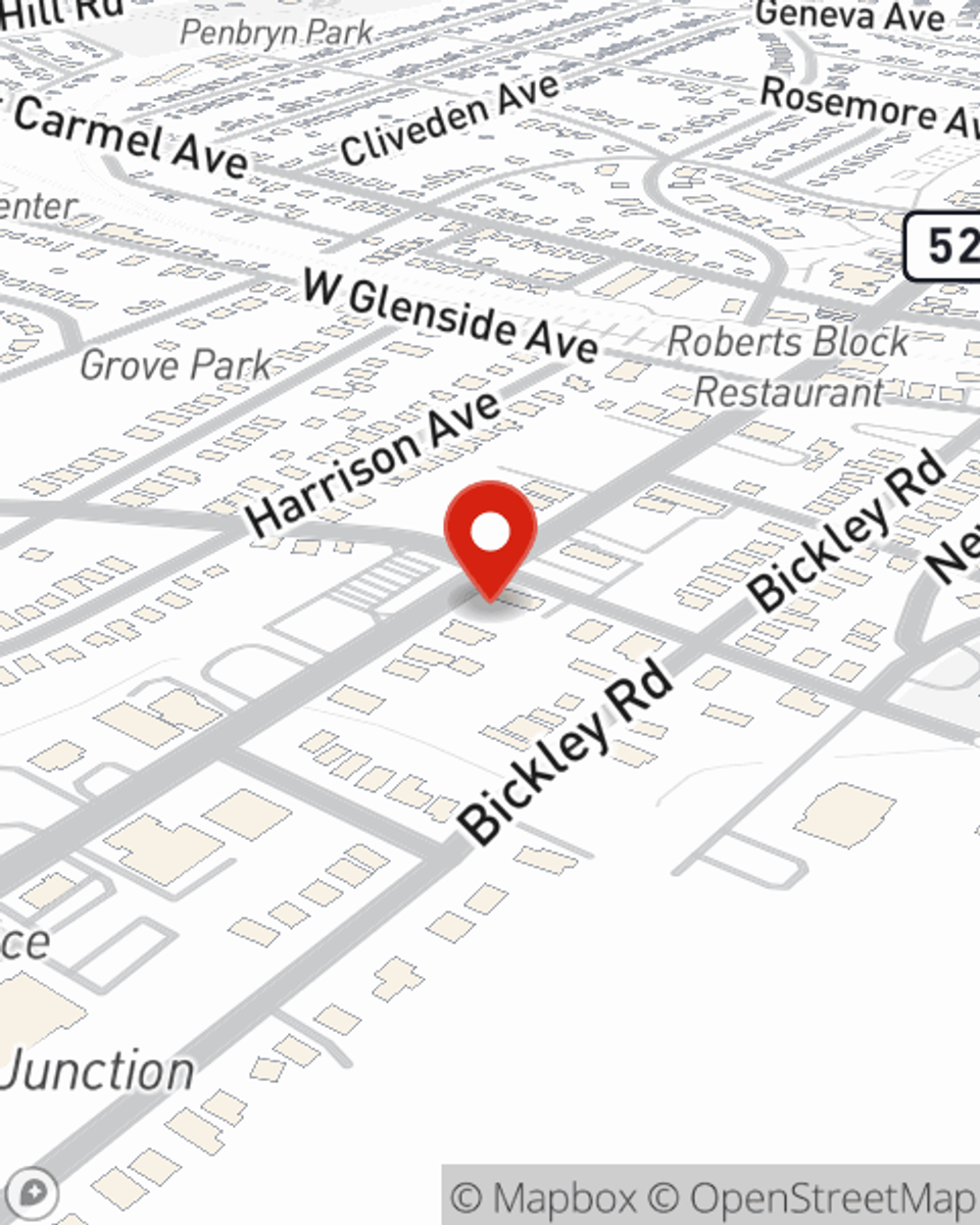

Business Insurance in and around Glenside

One of Glenside’s top choices for small business insurance.

Cover all the bases for your small business

State Farm Understands Small Businesses.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Catastrophes happen, like an employee gets injured on your property.

One of Glenside’s top choices for small business insurance.

Cover all the bases for your small business

Protect Your Business With State Farm

Protecting your business from these possible catastrophes is as easy as choosing State Farm. With this small business insurance, agent Stephanie Raieta can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

So, take the responsible next step for your business and visit with State Farm agent Stephanie Raieta to identify your small business insurance options!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Stephanie Raieta

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.